Swivel Finance v2 Rinkeby Testnet

Add to Watchlist

Added to Watchlist

Reward pool

$10,000

Not set

Expected profit

Unknown

USD

Max participants

∞

No limit

DropsEarn score

Neutral

Normal, Low Risks

Event details

The Swivel v2 testnet is live at https://swivel.exchange.

Swivel v2 significantly improves user experience and capital efficiency — providing a clear choice for both passive lenders, and active rate-traders.

Others may claim that they offer capital efficient solutions, but none come close to Swivel v2 which boasts a 100% increase in capital efficiency over any AMM based protocol.

Give the testnet a try and then drop on by Swivel discord to join the community and claim part of the $10,000 feedback program.

Testnet Prerequisites

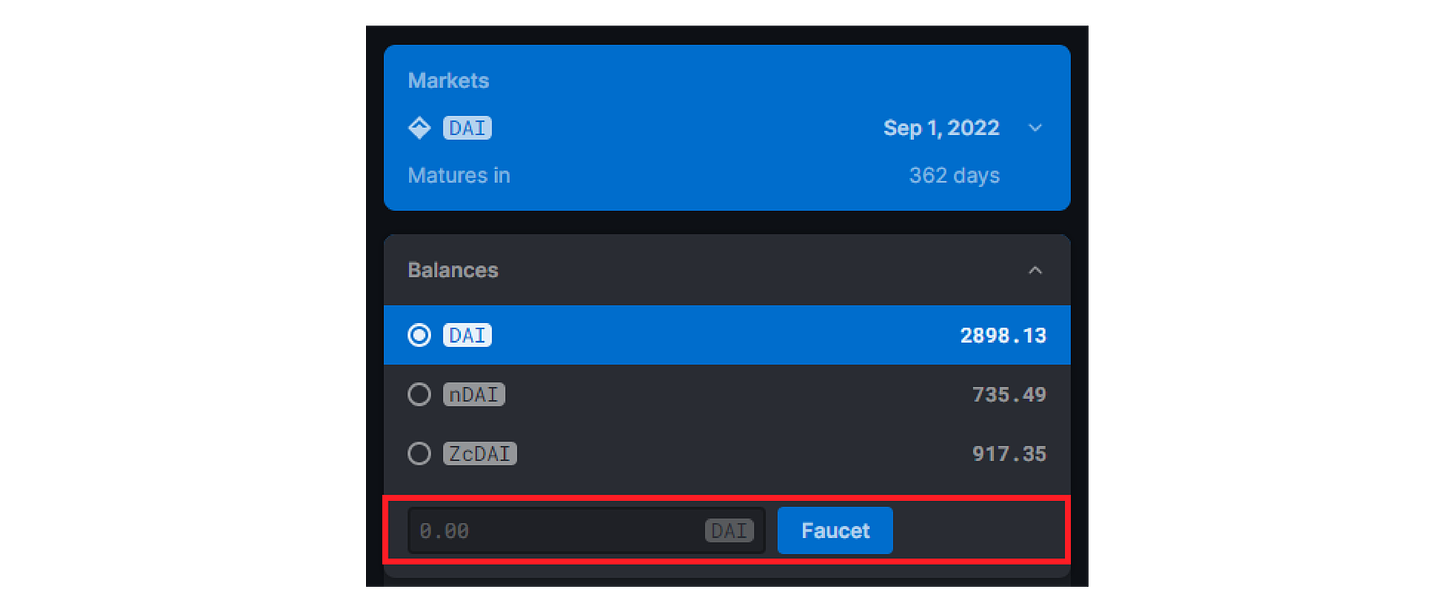

To interact with the Swivel v2 testnet, users first need to acquire Rinkeby ETH, as well as Rinkeby DAI or USDC.

Rinkeby ETH can be acquired using the: Official Rinkeby Faucet

Once in possession of Rinkeby ETH, navigate to Swivel exchange and faucet either DAI or USDC within the balances dropdown.

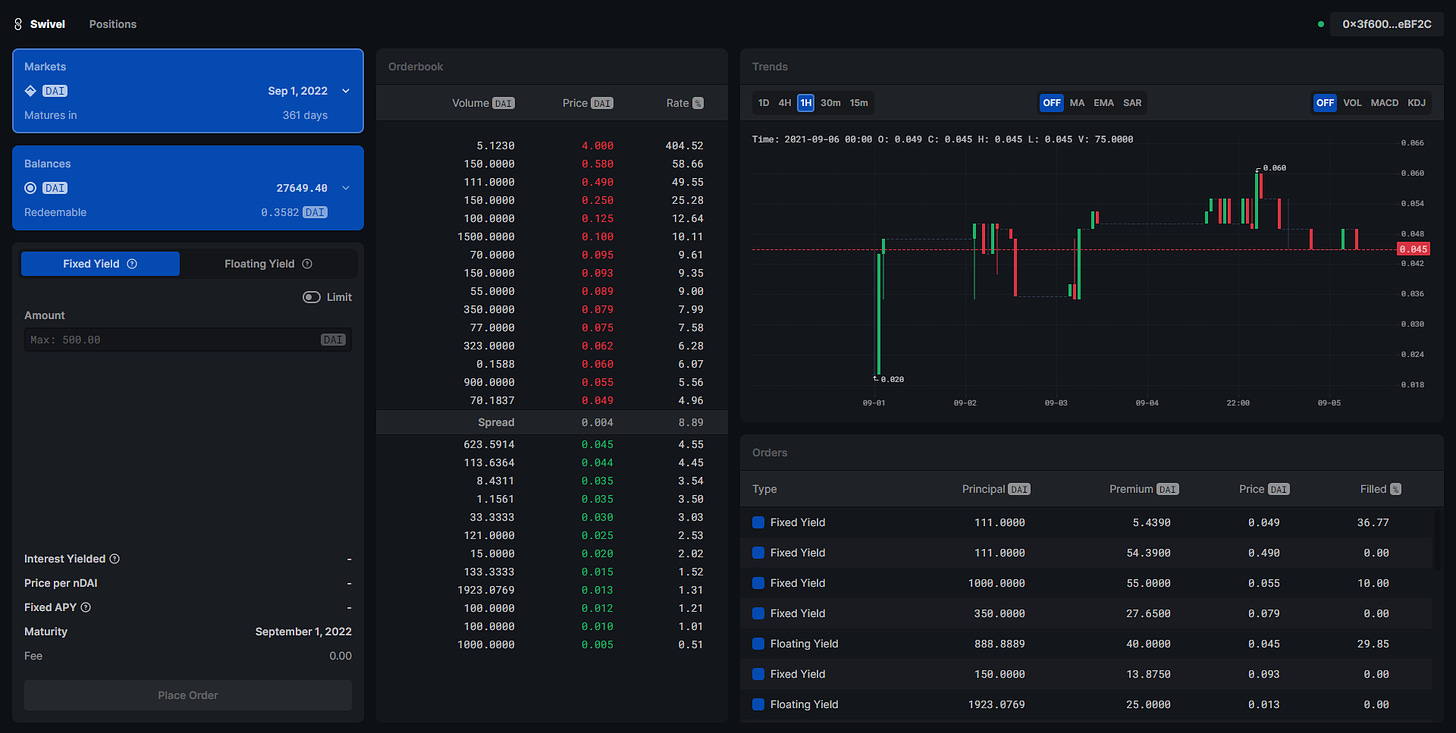

Swivel v2 Exchange

Similar to Element and Pendle (and others), Swivel allows users to split their tokens into two parts:

-

zcTokens: zcTokens are tokens which have been locked until a future date, and can be redeemed 1-1 for their full value upon maturity.

-

nTokens: nTokens are tokens which provide yield until a future date, generating interest based on 1-1 deposits in a yield-generating protocol.

Unlike other protocols, Swivel offers the ability to lend for a fixed-yield, extend floating lending exposure, or alternatively sell off their zcToken or nToken positions, all with shared liquidity on one orderbook.

This results in an optimal user experience as retail users are guaranteed the best prices, while institutional users can customize their lending positions and liquidity provision strategies.

A full description of the exchange is available in docs!

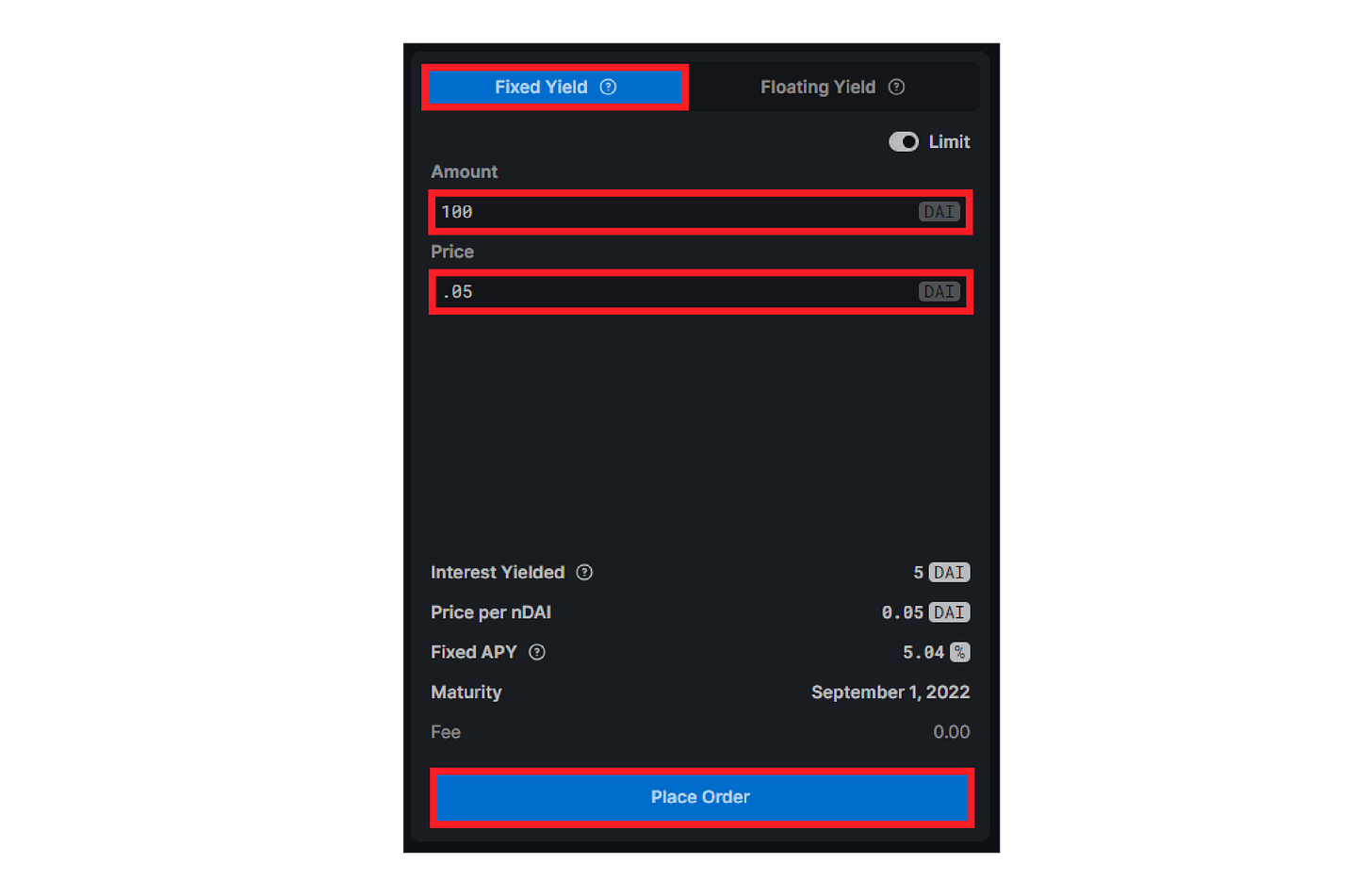

Fixed-Yield Lending:

Users wishing to lend for a fixed-yield can do so by splitting their tokens into zcTokens + nTokens, and selling their newly minted nTokens. This leaves the user with an immediate yield, and a 1-1 zcToken deposit, redeemable upon maturity.

Other protocols may require users to complete this process over ~6 transactions.

Swivel simplifies this workflow, requiring only 1.

Further, as with all transactions on Swivel, users can either avoid transactions all-together by placing limit orders or can immediately take the best price available with market orders.

Steps

- Select your desired asset and maturity.

- Input the amount of DAI you would like to lend.

- Identify the price (rate) you will receive.

- Approve the Swivel contract access to your DAI.

- Lock in your fixed-rate position!

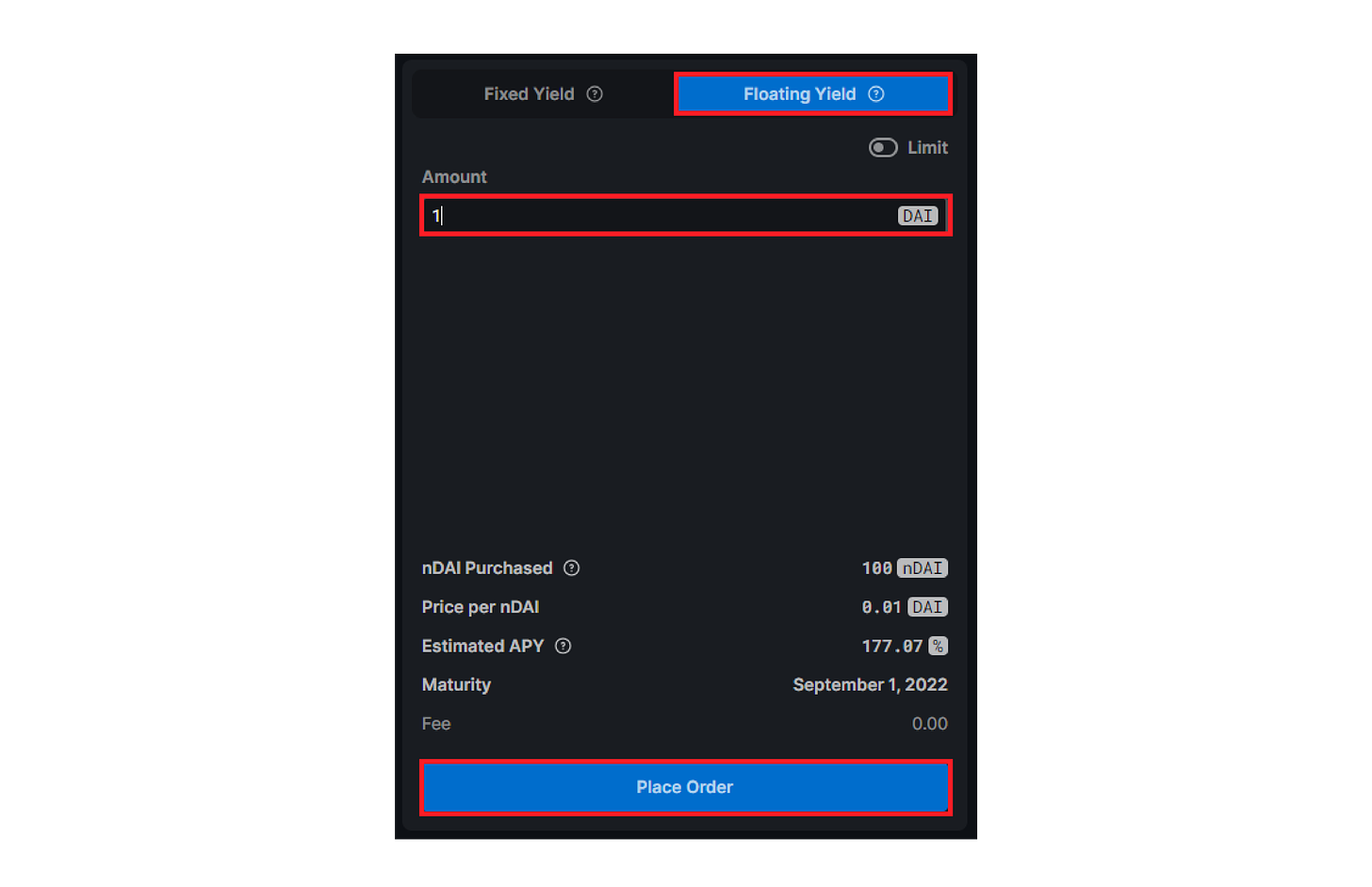

Floating-Yield (Purchasing nTokens)

If a user wants to (for one of many reasons) purchase nTokens and extend their lending exposure, they simply identify their price, and purchase nTokens.

Similarly, users can either avoid paying for a transaction by placing limit orders, or can immediately take the best price available with a market order.

Steps:

- Select your desired asset and maturity.

- Input the amount of DAI you would like to spend.

- Identify the price (rate) you will pay.

- Approve the Swivel contract access to your DAI.

- Purchase nDAI!

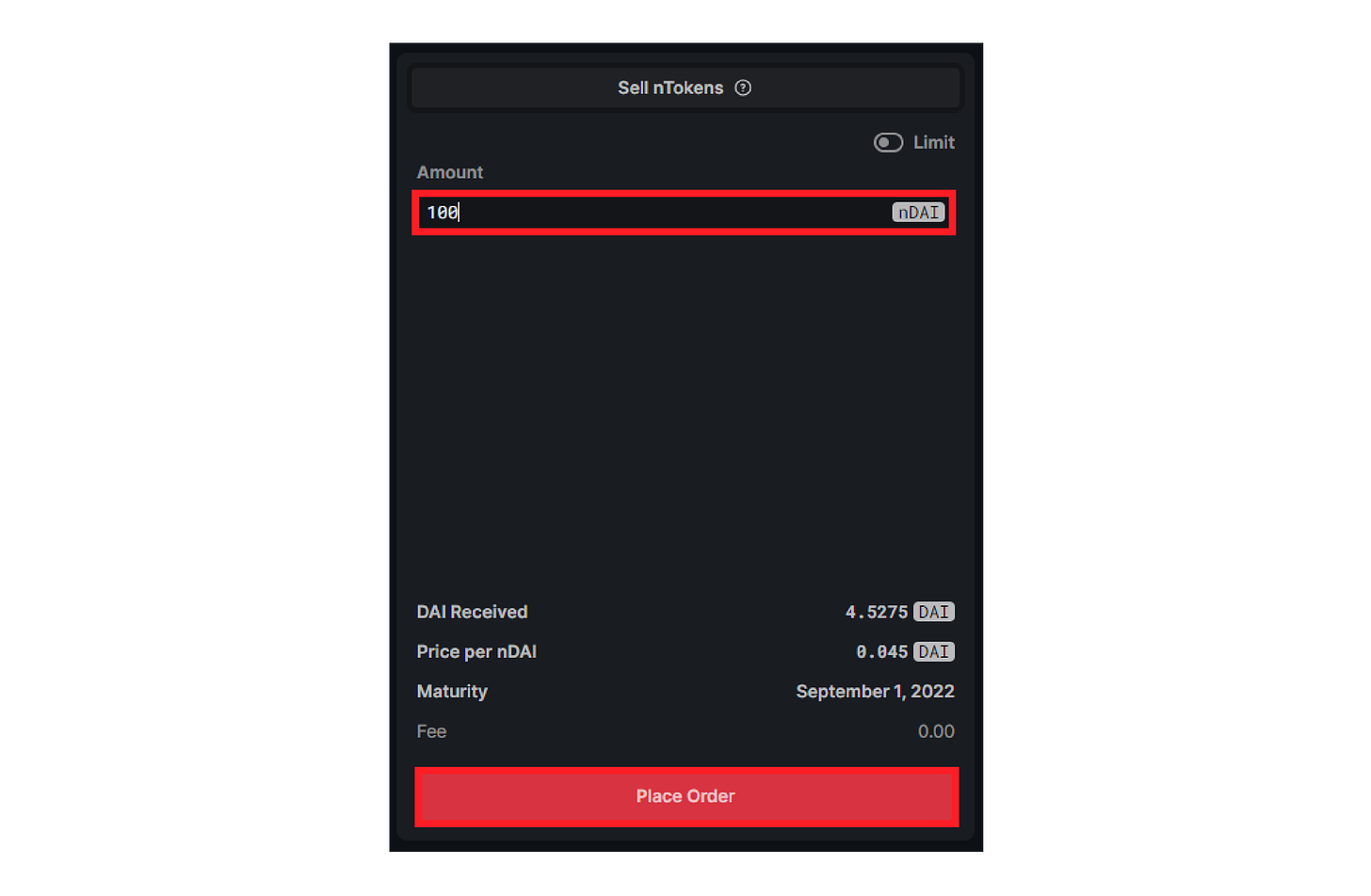

Selling nTokens

If a user wants to exit an nToken position before maturity, they can sell their nTokens back to the market.

Steps:

- Select your desired asset and maturity.

- Input the amount of nDAI you would like to sell.

- Identify the price you will receive.

- Sell your nDAI!

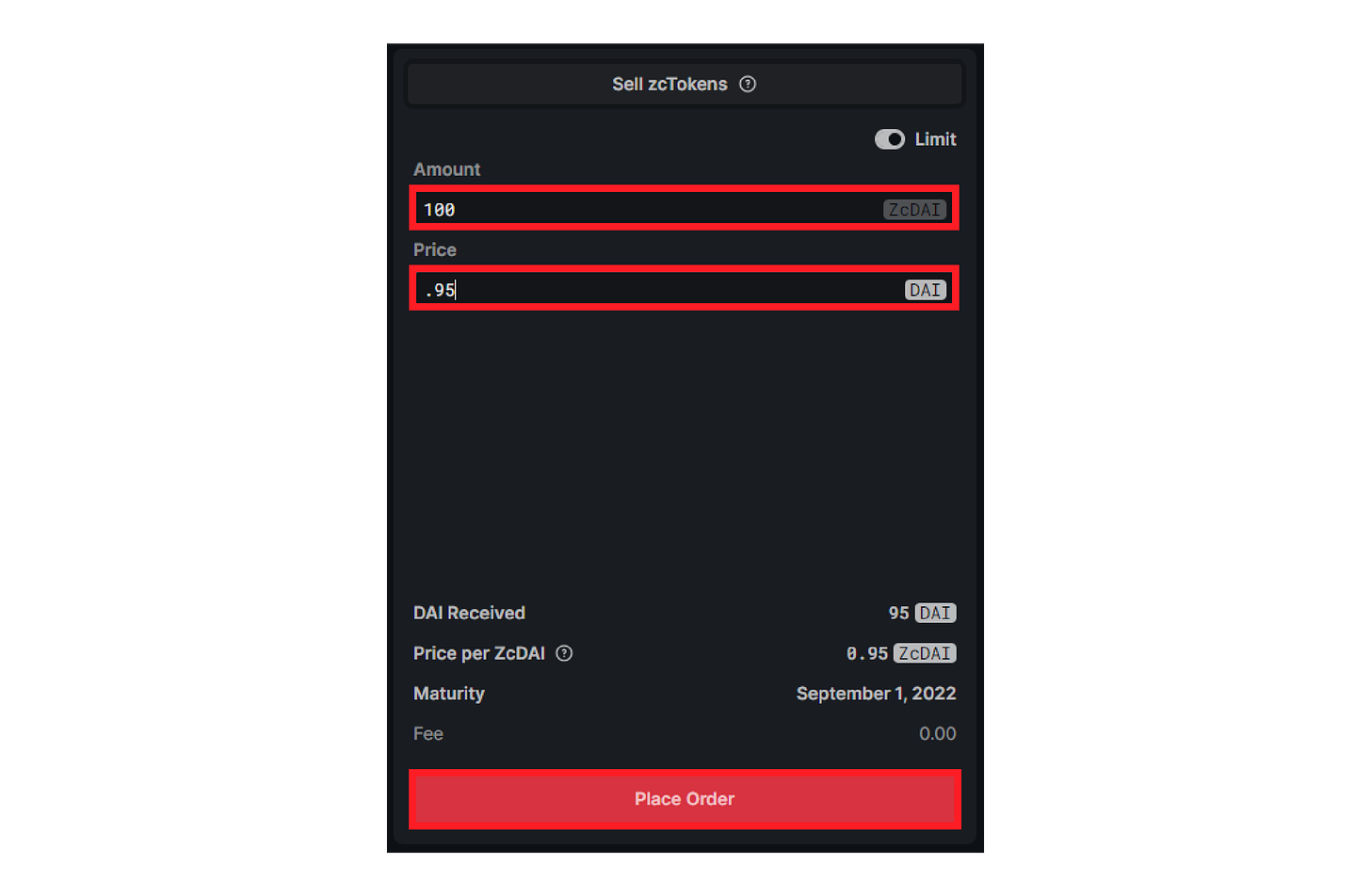

Selling zcTokens

If a user wants to exit a fixed-yield (zcToken) position before maturity, they can sell their zcTokens back to the market.

Swivel enforces an orderbook conversion such that 1 zcToken can always be sold to the market for 1 - (nToken price).

Example:

1 DAI = 1 nDAI + 1 zcDAI

nDAI = .05 DAI

zcDAI = 1 - .05 = .95 DAI

Steps:

- Select your desired asset and maturity.

- Input the amount of zcDAI you would like to sell.

- Identify the price you will receive.

- Sell your zcDAI!

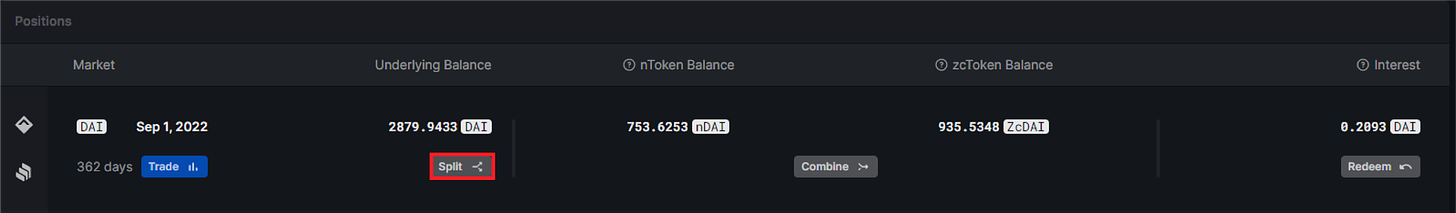

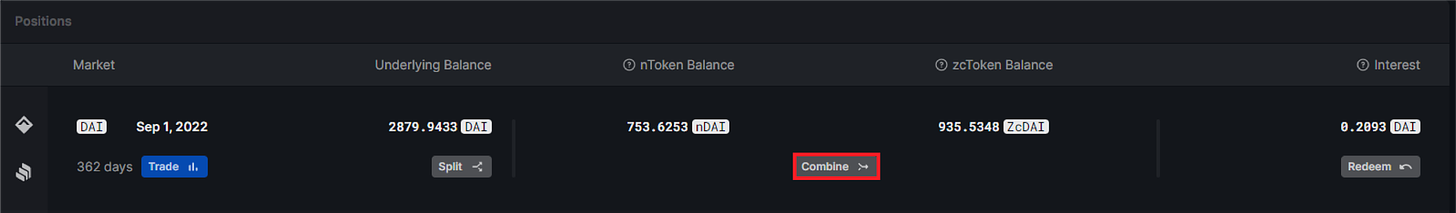

Splitting/Combining Tokens

To split an underlying token into zcTokens + nTokens, or combine zcTokens + nTokens back into underlying tokens, a user must first navigate to the positions page.

Splitting:

Combining:

Steps:

- Select your desired asset and maturity.

- Select split/combine.

- Input the amount of tokens you would like to split/combine.

- Split/combine your tokens!

Feedback Program

Swivel last feedback / bug bounty program was a massive success! With ~500 separate entries, and Swivel were able to identify pain points, and iterate upon their exchange confidently.

Swivel are extending this program into Swivel v2 testnet with an additional $10,000 in rewards.

Just visit Swivel discord and drop feedback in the #testnet-suggestions or #testnet-support channels. Once your feedback is verified you’ll be added as a member of the “QA” team and you’ll receive scaling rewards for your contribution!

Links

About

After a few months of heads down development, Swivel Finance are happy to announce that Swivel v2 is live on Rinkeby. Come check it out and earn part of the $10,000 feedback program.

Activity Type

Date

6 Sep 2021 03:00(UTC+3) - 6 Feb 2022 03:00(UTC+3)

Registration

Closed

When Reward:

None

Event Status