StaFi StakingDrop Campaign

Add to Watchlist

Added to Watchlist

Reward pool

~ $400,000

2,000,000 FIS

Expected profit

proportionally

FIS

Max participants

∞

No limit

DropsEarn score

Medium

Easy, Low Risks

How To Participate

The StakingDrop page is already LIVE: www.stafi.io/stakingDrop.

The drop campaigns will start in early August! You can check the details in StaFi documentation once they go live.

Introduction of StakingDrop

Airdrops have evolved throughout the years: from simple coin-dropping to conditional airdrops, then LockDrop, now also WorkLock and Liquidity Farming. The performance of airdrops varies from their design, but it is undeniable that the lingering side-effect of airdrops has been haunting project teams, which is making the community have skin in the game.

It is super easy to obtain most airdrops — you just need to register an account and get some free coins. For example, in the early days of Ethereum, most addresses got airdropped a lot of random coins — and that still happens today. There were even projects solely focused on airdrops. While projects may try to build communities via airdrops, it doesn’t necessarily build a solid one. Since 2018, there were several projects which airdropped tokens excessively and suffered greatly from the secondary market pressure.

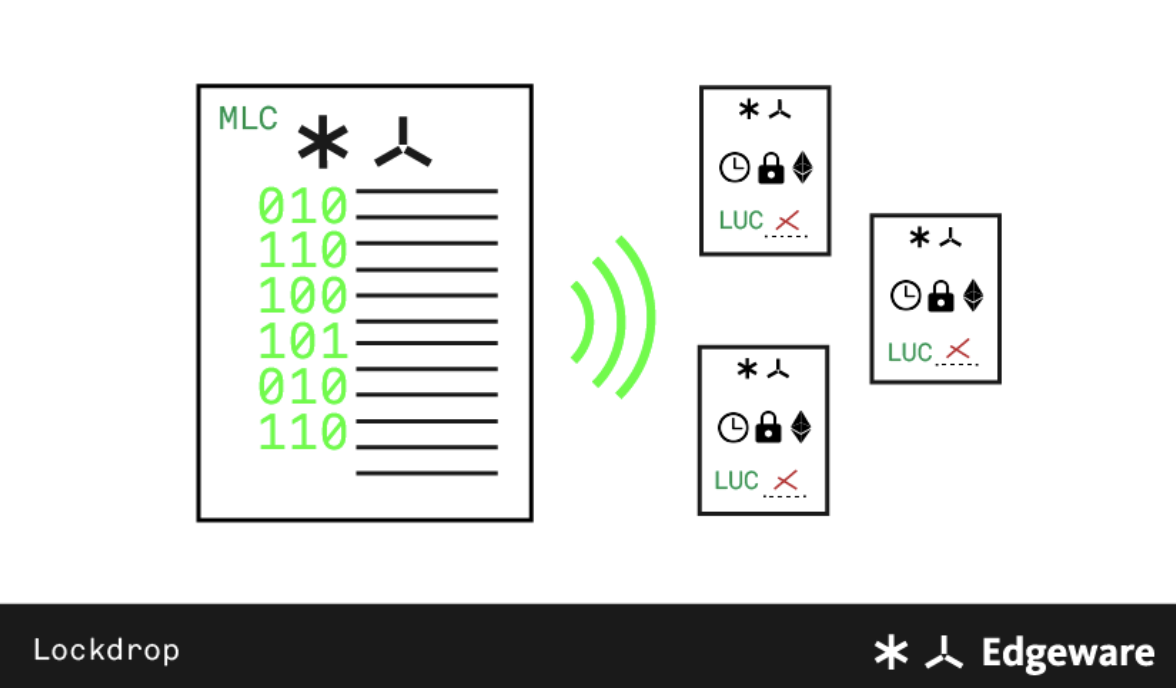

As for LockDrop, it makes users provide certain crypto-economic representation (can’t really call it collateral) to obtain the airdrop. The collateral is usually an ETH deposit that is locked for a certain period of time in which the size of the airdrop is proportionate to the amount of ETH deposited and the lockup.

However, the opportunity cost of locking ETH for users is amplified by the fact that projects cannot extract value from locked ETH. It has been proven that in most locking designs, the value of locked tokens is decoupled from the value of the project. And that is quite often the case, but then the locking design doesn’t contribute much in such circumstances.

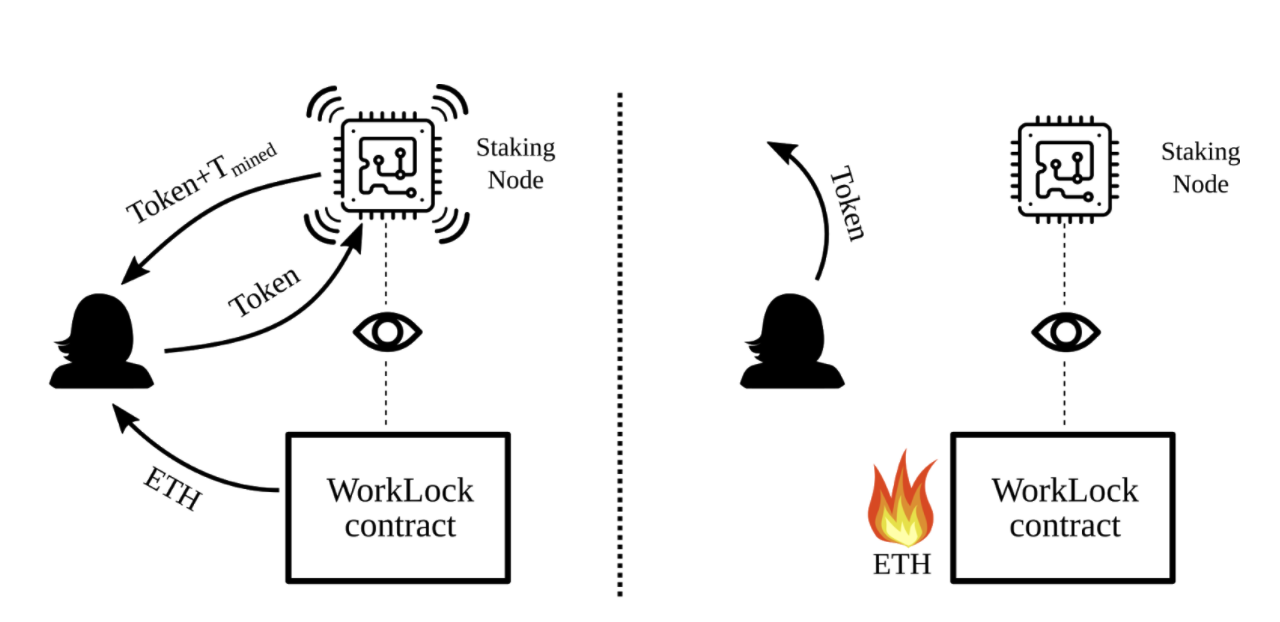

WorkLock is a newer innovation. It makes users stake their coins in addition to locking their ETH — or the locked ETH will be burnt. It’s somewhat of an upgrade to LockDrop as it allows teams to grasp a tighter control of the locked airdrops (burning the collateral), and also making sure the airdropped coins are being staked (staking is locking to some degree). Thus, secondary market selling pressure is reduced drastically.

However, the problem is that the value of locked tokens and the airdrop may contradict with each other in anyway. When the airdrop value is greater than that of locked tokens, a lot of ETH will be burnt and the airdrop will be massively unstaked because the users would want to earn more, thus harming the stability of the system. On the contrary, users’ enthusiasm and trust in the project will be determined by the real value of the airdrop.

Taking into accounts the advantages and shortcomings of different models, we have settled on StakingDrop. It is aimed at airdropping to targeted users — stakers — as they will form a real user base in the future.

In StakingDrop, staking is used as locking. Staking tokens should be locked on their original chain, thus losing their liquidity. Therefore, despite StakingDrop requiring a longer locking period when users are not allowed to unstake — it is offset by the extra FIS rewards to those users.

The user acquisition cost is optimized then. If you would like to discuss different economic designs, jump in our Telegram Chat!

StakingDrop in Details

In the first stage of StakingDrop, stakers will be able to submit their staking address and initiate a small transaction to the designated address or provide a signature to claim FIS. Very simple actually, all within a few clicks!

The FIS airdrops target stakers in general, so users can claim their airdrops no matter whether they stake beforehand or after. The size of airdrops is proportionate to the value of assets they stake.

The x-coordinate is the airdrop cycle(day). Assuming that the cycle is n days, the theoretical airdrop a user can get is TotalDrop, then the slope formula is (2 * TotalDrop) / (n * (n + 1))

After a Staker submits a Proof, they will receive FIS airdrops (linear). If the Staker unstakes during the airdrop period, the airdrop will be terminated. It should be also noted that the StakingDrop solution will continue until the StaFi mainnet is launched. After launching, StakingDrop will enter a new stage with more projects coming in!

Potential problems and solutions

In order to prevent users from gaining unfair advantage, we have designed some restrictions. Those are mainly to prevent non-staking users, or individual staking users from obtaining FIS airdrops.

Stakers’ incentives will last the whole airdrop period, and the number of airdrops gradually increases over time. Combined with a linear reward curve, the design should withstand most of the malicious gamification methods.

Moreover, in order to better balance the number of airdrops for each PoS project, the airdrop mechanism has set up a certain percentage of airdrop pools for each token. The size of the pool is related to the project’s popularity and market value. StakingDrop will support airdrops for almost the same projects before and after the mainnet of Stafi is activated.

On how Stafi chooses projects, please check the article.

The meaning of the StakingDrop for the ecosystem

StakingDrop is part of the inflationary incentives of StaFi. It can be seen as the second wave of incentives for stakers, which will increase the staking ratios and making the projects and StaFi safer as well.

When Staking Contracts rolls out, users who stake through contracts will keep making the system safer while obtaining liquidity. It should also be noted that the liquidity will not affect the existing Staking Tokens.

StaFi is confident about the long-term stability of the overall PoS ecosystem brought by this type of user-targeted engaging airdrop design.

About

Stafi Protocol is built with the aim to empower the liquidity of staking assets — like Cosmos, Tezos, Polkadot, and others — while enhancing staking rates and making PoS networks safer. In order to encourage the usage of Stafi, we will be rolling out a unique campaign named StakingDrop. It’s easy to get involved as long as you stake assets in the designated projects we will be announcing. Prepare for the $FIS stakedrop mining-farming.

Activity Type

Date

4 Aug 2020 09:00(UTC+3) - 31 Aug 2020 14:00(UTC+3)

Registration

Closed

When Reward:

None

Event Status