Injective Protocol & DAO Maker Social Mining

Add to Watchlist

Added to Watchlist

Reward pool

Not set

INJ

Expected profit

Unknown

equal in INJ

Max participants

∞

No limit

DropsEarn score

Neutral

Normal, Low Risks

Detailed Information

Injective Protocol will have an opportunity to earn INJ tokens by growing and supporting the Injective Protocol ecosystem. This may come in the form of advocacy, supplementary development, liquidity participation, creation of educational content, project introductions, and virtually any other means of supportive actions. This is a unique opportunity for the community to be a part of the project’s highly anticipated launch phase.

What is Social Mining and the Injective Hub?

Social Mining is the technology that powers the Injective Hub, which is a fun and inclusive way for community members to collaborate and be a part of a range of activities that benefit everyone involved with a project. All that’s needed is the creation of an account on the Injective Hub.

Prior to listing, the platform will be open access. However, upon listing, which is happening quite soon, platform access will be limited to INJ token holders.

Social Mining aggregates each user’s involvement into a news feed for other users. Involvement can come in the form of on-chain proofs like using the token in the protocol, adding liquidity on DEX, being an active buy-side trader, and more. It also involves advocacy-based merits, ranging from actions as simple as actively engaging with the project’s social posts and accounts to generating new social feeds or accounts dedicated to the growth in project exposure.

Given that market awareness needs to be accompanied with eased understanding, captivating educational content is also an important supportive measure. However, there are no limits to the means with which community members can be supportive. Each member is able to be creative and grow the project’s scope and ecosystem in a collaborative yet decentralized environment.

What is Injective Protocol?

Injective Protocol is a layer-2 decentralized exchange protocol that provides traders with unrestricted access to new decentralized derivatives markets. With Injective, traders can create and trade on any derivatives market, and benefit from high speed trades with zero gas fees on a completely open and permissionless platform.

Injective maintains a fully decentralized orderbook, and allows community members to participate in governing the platform. Traders can also earn cross-chain yield on Ethereum, Cosmos, and other decentralized networks.

Injective ProtocolLayer-2 DeFi protocol for cross-chain derivatives trading that enables anyone to create and trade on markets of their choice indefinitely, while being able to earn liquidity mining rewards for network participation.

Go-to market strategy

Trading is an integral component within the cryptocurrency sector but a number of trade-offs arise when traders seek to use decentralized exchanges.

Many DEXs today claim to be decentralized but are actually centralized in most aspects besides custody. From restricting access to certain user demographics, retaining proprietary control over exchange infrastructure, every central limit orderbook DEX that we have seen has centralized components that allow traders to be subject to the will of a some omnipotent authority. This is the fundamental problem that Injective solves.

The common rationale against full decentralization is that efficiency and user experience are sacrificed. We at Injective reject this notion and have committed ourselves to turning the vision of a highly performant, permissionless, and fully-decentralized exchange protocol into reality.

This provides Injective with an unmatched value proposition and go-to market strategy including but not limited to the following advantages:

- Layer-2 decentralized derivatives trading: Injective is able to achieve unmatched DEX trading speeds while charging zero gas fees for trading due to its novel layer-2 architecture.

- Trade on any market: Injective allows anyone to create and trade on any derivative market (i.e. synthetic assets, crypto assets, etc.) of their choosing using only a price feed, thereby opening up limitless opportunities for trading on markets not found on other exchanges.

- Cross chain trading and yield generation: Injective is capable of supporting a diverse array of trading and yield generation across distinct layer-1 blockchain networks.

- Community driven network governance: Injective's network is governed by its decentralized community in which new listings or network changes are all voted on via a DAO structure.

- Liquidity mining incentives: Injective's community is able to capture value from the network via various liquidity mining programs that have been natively built onto the network to spur continued growth.

- High Speed DEX: Injective brings an order of magnitude speedup by scaling trade execution and settlement on layer-2, while also providing traders with near-instant order cancellations using Injective's decentralized trade execution coordinator.

Injective also employs a robust ecosystem development strategy in order to grow our trader base further:

- Ecosystem advocates: By empowering community participants to be Injective ambassadors, Injective will be able to grow a robust and sustainable trader and developer ecosystem across the globe.

- Increasing peg zones: Injective can offer cross-chain capabilities that interconnect multiple layer-1 ecosystems while inviting traders to join the Injective ecosystem.

- Incentivized testnet and trading competition: Injective investors, community members, and token holders can participate in the testnet and provide valuable insights for the upcoming mainnet while being compensated for their efforts.

- On-chain referral system: Injective network participants can capture a high percentage of the exchange fees that they bring to the ecosystem.

Product viability

DEXes are rapidly rising in demand with platforms such as Uniswap currently handling over $100M in volume on a daily basis. However, high gas fees coupled with slow transaction speeds and poor UX greatly limit the usage of these DEXes. This means the vast majority of traders continue to rely on centralized exchanges for everyday trading despite the high fees and centralized nature of these larger exchanges.

Injective offers a trading experience that seamlessly combines the best of centralized and decentralized exchanges while also augmenting additional innovations on top in order to enable a new era within decentralized finance. Fast transaction speeds due to a layer-2 architecture, zero gas fees and a decentralized trading experience that retains the UX of a centralized exchange aids in creating an ideal trading infrastructure for retail and institutional traders alike. In addition, Injective gives individuals the freedom to create any derivatives market of their choice, opening up an unlimited number of markets to trade on.

In addition, Injective offers a number of incentivized liquidity mining opportunities that rewards traders for participating on the DEX as well as an incentivized staking program that rewards holders of INJ.

Product roadmap

Product dive

Injective Protocol is comprised of three principal components:

- Injective Chain

- Layer-2 Derivatives Platform

- Injective Exchange

Injective Chain

The Injective Chain is a fully-decentralized sidechain relayer network which serves as a layer-2 derivatives platform, trade execution coordinator (TEC), and decentralized orderbook. The core consensus is Tendermint-based.

Smart Contracts

The Injective Chain provides a two-way Ethereum peg-zone for Ether and ERC-20 tokens to be transferred to the Injective Chain as well as an EVM-compatible execution environment for DeFi applications. The peg-zone is based on Peggy and the EVM execution is based on Ethermint.

Trade Execution Coordinator

The Injective Trade Execution Coordinator (TEC) is a decentralized coordinator implementation based on the 0x 3.0 Coordinator specification. The Injective TEC safeguards trades from front-running using Verifiable Delay Functions and enables lower-latency trading through soft-cancellations.

EVM Execution Environment

The Injective Chain EVM is a geth based EVM implemented as a custom Cosmos-SDK module (akin to Ethermint).

The user and developer experience for deploying and interacting with contracts on the Injective EVM will be the same, and all of the Ethereum RPC methods will be supported on the Injective EVM.

Decentralized Orderbook

Injective's Decentralized Orderbook is a fully decentralized 0x-based orderbook enabling sidechain order relay with on-chain settlement - a decentralized implementation of the traditionally centralized off-chain order relay used by nearly all central limit order book decentralized exchanges.

Nodes of the Injective Chain host a decentralized, censorship-resistant orderbook which stores and relays orders.

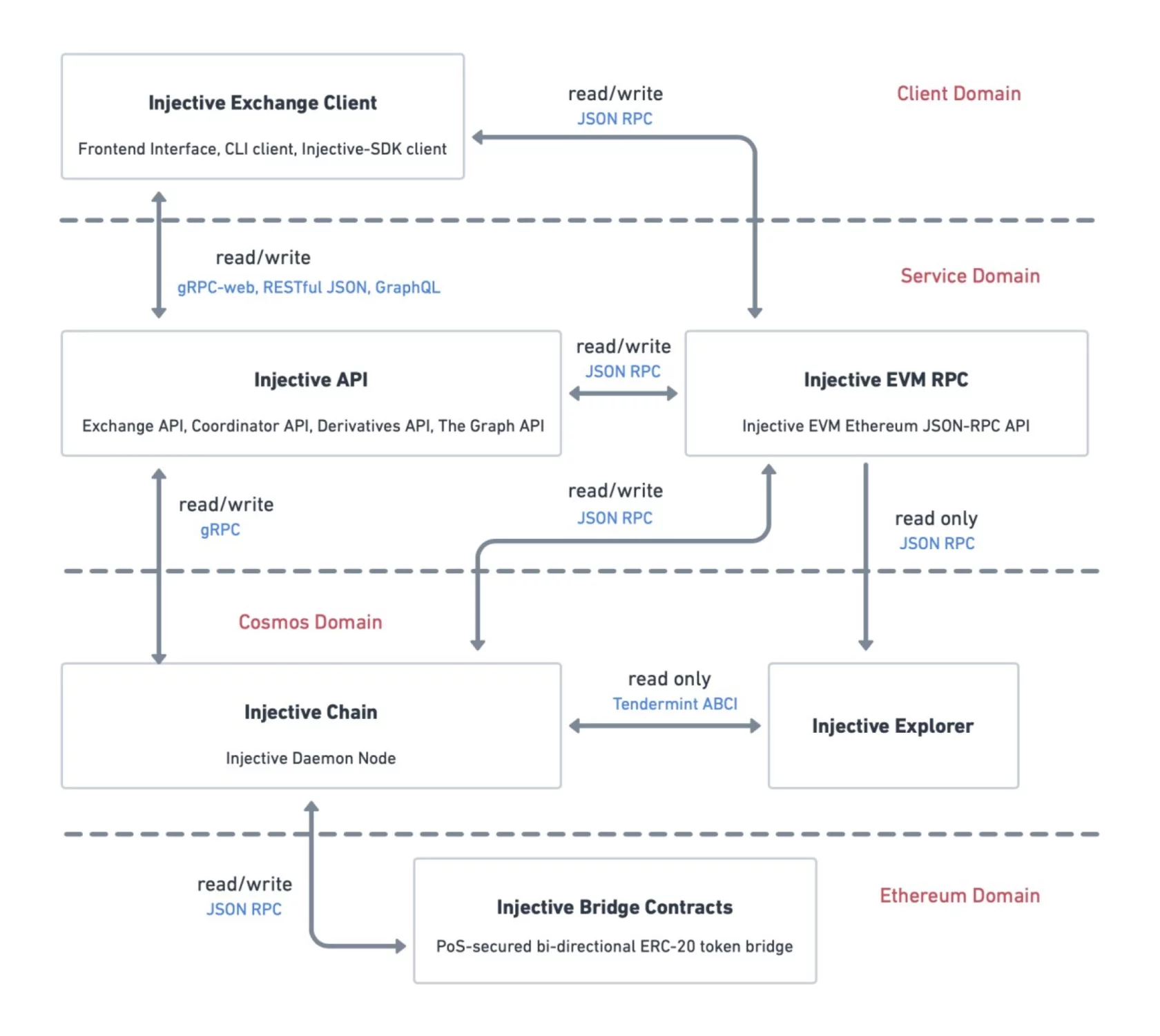

Injective API

Injective API nodes have two purposes:

- Providing transaction relay services;

- erving as a data layer for the protocol.

The Injective API supports the Injective Futures API, the 0x Standard Relayer API version 3 (SRAv3), and the 0x Standard Coordinator API. The specification for this API can be found at api.injective.dev.

The API also provides abstractions for protocol actions including staking, voting and governance.

Layer-2 Derivatives Platform

The Injective Chain supports building generalized derivatives/DeFi applications through two avenues: the Injective Futures Protocol and general smart contracts.

Injective Futures Protocol

The Injective Futures Protocol is deployed on the Injective Chain as a Cosmos-SDK based application. This protocol enables traders to create, enter into, and execute decentralized perpetual swap contracts and CFDs on any arbitrary market.

Ethereum ⇆ Injective Peg Zone

Both ETH and ERC-20 tokens can be transferred between Ethereum and the Injective Chain through the Injective Peg Zone. The process to do so follows the standard flow as defined by Peggy.

Ethereum → Injective Chain

The following is the underlying process involved in transferring ETH/ERC-20 tokens from Ethereum to the Injective Chain. Validators witness the locking of Ethereum/ERC20 assets and sign a data package containing information about the lock, which is then relayed to the Injective chain and witnessed by the EthBridge module. Once a quorum of validators have confirmed that the transaction's information is valid, the funds are released by the Oracle module and transferred to the intended recipient's address. In this way, Ethereum assets can be transferred to Cosmos-SDK based blockchains.

This process is abstracted away from the end user, who simply needs to transfer their ETH/ERC-20 to the Injective Peg Zone (IPZ) contract.

Injective Chain → Ethereum

Validators witness transactions on the Injective Chain and sign a data package containing the information. The user's ETH/ERC-20 on the Injective Chain is burned, resulting in unlocking the ETH/ERC-20 on Ethereum. The data package containing the validator's signature is then relayed to the contracts deployed on the Ethereum blockchain. Once enough validators have confirmed that the transaction's information is valid, the funds are released/minted to the intended recipient's Ethereum address.

Injective Exchange

Frontend Interface

Injective Protocol is a fully decentralized protocol which allows for individuals to access the protocol in a permissionless manner. Injective provides a user-friendly frontend interface which individuals or companies can run locally or host on a web-server to interface with the protocol. This interface is also deployed on IPFS.

Relayer Incentives

Nodes and validators of the Injective sidechain have the capability to act as relayers who can cater to traders in their desired ways (e.g. a relayer can provide an improved interface/API catering to a specialized group of traders). As an incentive mechanism for relayers to provide the best experience for traders, Injective has an on-chain referral system that rewards relayers who originate orders into the shared orderbook.

Market Maker and Liquidity Mining Incentives

Injective plans to incorporate a liquidity mining scheme and distribute a fixed number of INJ tokens daily weighted by the liquidity each network participant provides.

Token distribution

Token release schedule

About

Injective Protocol launches Community Hub where you can participate, complete tasks and get rewards.

Activity Type

Registration

Open

When Reward:

None

Event Status